Schauer Group’s risk management process is an innovative approach to traditional insurance procurement, designed to uncover risk exposures from day-to-day business operations.

Schauer Group’s risk management process is an innovative approach to traditional insurance procurement, designed to uncover risk exposures from day-to-day business operations.

Schauer Group works with your management team to understand your business and help you measure and control risk. We focus on your risk profile with the intention of increasing risk management efficiencies. This comprehensive risk management process helps to identify factors and solutions to manage risk, beyond insurance coverage alone.

By utilizing Schauer’s strategic risk management process for your business, together we create a risk profile tailored to your individual needs. Schauer Group takes a “total cost of risk” approach, aggregating techniques of risk control and risk financing to improve a client’s overall risk profile.

Businesses with or without a full-time risk management team engage Schauer Group for risk management expertise throughout Ohio and beyond. We act as an outsourced risk management department for your team.

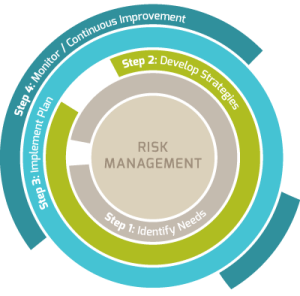

Our Risk Management Process

Some agencies sell insurance on price alone, turning a vital risk management process into a commodity. At Schauer Group, we seize the opportunity to stand apart from the competition. Our services, approach to managing risk, and our people build a culture around clients who seek not only competitive costs, but industry-leading knowledge and capabilities.

We don’t just sell policies; we immerse ourselves in our clients’ businesses to proactively reveal risks and protect their assets.

We gain insight into your organization to better recommend insurance and risk management solutions. Whether you are looking for comprehensive risk management, business or personal insurance, human capital services, employee benefits, risk consulting or surety bonding, we follow a detailed risk analysis process to understand your business and your business industry and deliver risk advice that you and your business can rely on.

Schauer Risk Management Approach

Step 1 – Identify your goals and risk exposures.

Step 1 – Identify your goals and risk exposures.

Our team takes a comprehensive and immersive approach to learning about your business and the risk it encounters. We begin by asking questions, conducting interviews, visiting job sites or touring facilities, and gathering information. This helps Schauer identify red flags and areas of need—some you may not even realize need attention. Our value comes in our ability to strategize, offer insights and work hard for your business to offer a broad perspective on how to best manage risk.

Step 2 – Develop a strategy around your goals and exposures.

This includes identifying the risk control techniques and the risk financing techniques, along with the strategic mix of risk management services that will work best for your business.

Step 3 – Execute the strategy.

Once we have developed your risk management profile and a strategy to manage your business risk, we will implement the risk management strategy expertly.

Step 4 – Continuous improvement and monitoring.

Our industry-leading 95-percent client retention rate says a lot about how we do business. We build long-term relationships with clients and communicate with them during the year on insurance and risk management trends, and external and internal factors that might impact coverage needs, not just 90 days before renewal time. This continuous monitoring and evaluation of your risk management profile demonstrates our role as your true partner in risk management.

Risk Control Techniques

When developing your customized risk profile and risk management strategy, we use risk control techniques, including:

- Avoidance—The best means in our risk control arsenal; a way to avoid the threat of risk all together.

- Loss Prevention—A system to help mitigate loss.

- Loss Reduction—A process to reduce risk when some risk is absolutely unavoidable.

- Separation—Dispersing key tangible assets to minimize the impact to your business.

- Duplication—Creating a backup plan for your business or its key systems.

- Diversification—Diversifying your lines of business to minimize the threat of loss from one single line of business.

Our Risk Management Services

- Customizable on-site/off-site service options

- Exposure analysis—Our process for uncovering areas in your business that leave you exposed to risk.

- Business Insurance—At Schauer Group, we analyze risk and recommend coverage based on overall value and your company needs. We represent the top-rated property and casualty insurance companies.

- Management of self-insured retentions/retained risks—Schauer can analyze and advise your business about whether utilizing a self-insured retention program is right for you.

- Risk Consulting—For clients who are happy with their current business insurance provider but seek Schauer Group’s independent analysis and audit.

- Claims management

- Manage first party claims

- Coordinate/audit TPA Services

- Alternative risk financing strategies

- Insurance policy services

- Internal management reports and presentations

- Subcontractor management—We can assist with managing your subcontractors, including standardizing your management process, evaluating qualifications, developing certain subcontractor agreements and overseeing compliance.

Risk Financing Techniques

We also assess risk financing techniques, in order to achieve the least-cost coverage for your company’s loss exposures, depending on your specific risk profile, including:

- Risk Transfer—A risk management strategy to contractually shift risk from one party to another, including an insurance transfer, where risk is transferred to an insurer using an insurance policy, or a non-insurance transfer, where risk is transferred via hold harmless, indemnity, and insurance provisions in contracts.

- Retention—Retain the risk by not buying insurance or transferring risk.

Schauer Group: The Risk Management Experts

To deliver on our service promise as your true partner, our people meet the highest industry standards. Education is the foundation of our company; our people are required to seek advanced designations and degrees in insurance and/or business, including:

- Chartered Property Casualty Underwriter (CPCU®)

- Chartered Life Underwriter (CLU®)

- Masters of Business Administration (MBA)

- Registered Health Underwriter (RHU)

- Associate in Risk Management (ARMTM)

- Certified Insurance Service Representative (CISR)

- Chartered Healthcare Consultant (ChHC)

- Attorney (J.D.)

Advanced education coupled with a time-tested risk analysis process supports a culture of first-class client service at Schauer.

Enterprise Risk Management

Enterprise risk management is a specialized field within risk management services that goes beyond standard areas of evaluation. It assists companies in managing the risks that may elude easy measurements or be more difficult to contextualize.

Enterprise risk management includes risks such as reputation, legal and human resources management, supply chain, technological, financial and other controls.

Applying our cultivated risk management process, Schauer Group can help companies of all sizes and industries to define these more ambiguous areas of risk and determine the need and manner in which to actively manage them.